For Private Company-> Minimum 2 Directors, Maximum 15 Directors

For Public Company -> Minimum 3 Directors, Maximum 15 Directors

For One Person Company-> Only 1 Director, Maximum 15 Directors

For SPICe+:

INC-9 shall be auto-generated in pdf format and would have to be submitted only in electronic form in all cases, except where:

(i) Total number of subscribers and/or directors is greater than 20 and/or

(ii) Any such subscribers and/or directors haven either DIN nor PAN.

The first step to incorporate Limited liability partnership (LLP) is reservation of name. Form 1,has to be filed for reservation of the name of a LLP business.

After reservation of a name, user has to file Form Fillip for incorporating a new Limited Liability Partnership (LLP).

This Form Fillip contains the details of LLP proposed to be incorporated, partners’/ designated partners’ details and consent of the partners/ designated partners to act as partners/ designated partners.

LLP Agreement: Execution of LLP Agreement is mandatory as per Section 23 of the Act. LLP Agreement is required to be filed with the registrar in Form 3 within 30 days of incorporation of LLP.

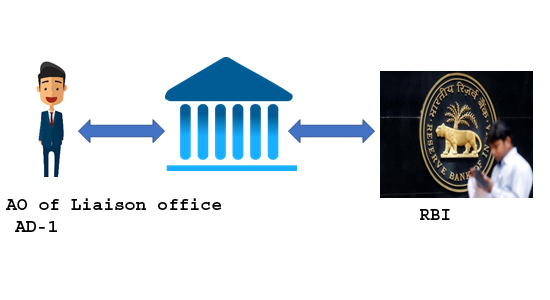

In India, a liaison office is a type of office that can be set up by a foreign entity to undertake liaison activities on behalf of the parent company outside India. The primary objective of a liaison office is to promote the parent company’s business interests, act as a communication channel between the parent company and Indian companies, and facilitate technical/financial collaboration between Indian companies and the parent company. Some of the activities that a liaison office can undertake in India include gathering information about the Indian market, exploring business opportunities, providing information about the parent company’s products/services, promoting trade and commerce, and acting as a representative office for the parent company.

However, a liaison office is not allowed to carry out any commercial, industrial, or trading activity in India, earn income, or enter into any contract on behalf of the parent company. It can only incur expenses related to its functioning and must be financed by the parent company.

However, if an LO in India is engaged in activities that go beyond preparatory or auxiliary activities, it may be considered a PE for tax purposes. For instance, if an LO in India is engaged in activities that generate revenue, such as negotiating contracts or concluding business deals, it may be considered a PE in India. In such cases, the foreign entity may be subject to income tax in India on the income attributable to the PE, based on the provisions of the Indian Income Tax Act and any applicable Double Taxation Avoidance Agreement (DTAA) between India and the foreign entity’s country of origin.

It is important for foreign entities with LOs in India to comply with the regulations of the RBI and the Income Tax Department and obtain a PAN in a timely manner. Failure to obtain a PAN or comply with other applicable regulations may result in penalties or other adverse consequences.

The Liaison office shall obtain TAN along with PAN from the Income Tax Authorities, open the bank account on setting up the offices in India and report the same in Annual Activity Certificate

The Liaison office shall obtain TAN along with PAN from the Income Tax Authorities, open the bank account on setting up the offices in India and report the same in Annual Activity Certificate.

Person as per section 2(31) includes company and as per section 2(17) company includes foreign company having presence in India. However, Liaison office (‘LO’) does not have a presence in India (refer the country DTAA which your company is in existence normally Liaison offices are not considered to have presence in India. Hence, there is NO need to file RoI.

However, there are certain other compliances which I have briefed below check whether you have complied this:

Under FEMA, 1999-Section 4(3)- The term ‘person resident in India’ means the following entities: AN office, branch or agency in India owned or controlled by a person resident outside India.

Under Income Tax Act, 1961–

The Act defines the term “foreign company” as “any company or body corporate incorporated outside India which has a place of business in India whether by itself or through an agent, physically or through electronic mode; and conducts any business activity in India in any other manner”. In order to be considered a “foreign company”, foreign entity has to fulfil both the criteria i.e. have a presence in India whether physical or electronic and conduct business activity in India.

The Foreign company is required to obtain a Certificate of Establishment of place of business (E-Form FC-1) in India from the ROC. The jurisdictional ROC will allot Corporate Identity Number (CIN) to such company.

For more information the attached file is there to help:-

There are several techniques and methodologies used in a forensic audit to uncover financial fraud and mismanagement. Some common techniques used in a forensic audit include:

These techniques are used in combination to provide a comprehensive and detailed analysis of a company’s financial records and transactions, and to identify any fraudulent activity or financial irregularities.

A forensic audit can help an organization in several ways, including:

The team of Deloitte Forensic (India) Pointed out the need of the same and added that “earlier the investigations were restricted to books and records but now there is a significant element of intelligence gathering”. Corporate Frauds which have forced the enforcement of forensic adit in recent times are PNB Scam, Dena Bank & Oriental Bank of Commerce Fraud, Vijay Mallya, Sahara Group Scam, Satyam Computers, Saradha Chit Fund, Ketan Parekh Scam etc.

| Sl. No. | Basis | Statutory Audit | Forensic Audit |

| 1 | Objective | To provide an opinion on the financial statements of an organization as to its ‘true & fair’ presentation | To investigate financial transactions to determine whether any fraud has actually taken place and collect evidence that may be used in legal proceedings |

| 2 | Scope | Limited to the financial statements of an organization | Broader than regular audit and may include an examination of financial records, interviews with employees, and a review of internal controls |

| 3 | Technique | ‘Substantive’ and ‘Compliance’ procedures | Analysis of past trend and substantive or ‘in depth’ checking of selected transactions are done. |

| 4 | Methodology | follows generally accepted accounting principles (GAAP) and auditing standards | follows investigative procedures and may require specialized skills, such as forensic accounting, computer forensics, and legal expertise. |

| 5 | Timing | Typically conducted annually or quarterly | Conducted when there is suspicion of financial fraud or wrongdoing |

| 6 | Period | Normally all transactions for the particular accounting period are considered. | There are no such limitations while conducting forensic audit and accounts may be examined in detail from the beginning. |

| 7 | Management Representation | Auditor relies on the management certificate/ representation of management | Independent verification of suspected/selected items carried out. |

| 8 | Off Balance-sheet items (like contracts etc.) | Used to vouch the arithmetic accuracy & compliance with procedures | Regularity and propriety of these transactions/contracts are examined. |

| 9 | Adverse findings, if any | Negative opinion or Qualified opinion is expressed with/ without quantification. | The auditor aims at legal determination of fraud and also naming persons behind such frauds. |

| 10 | Reporting | results in an opinion on the financial statements of an organization | results in a report that provides evidence of financial fraud or wrongdoing. |

| 11 | Audience | typically the management, shareholders, and regulatory bodies | may include law enforcement agencies, attorneys, and the courts |

Ownership & Obligation: Website www.mnrsindia.com is owned and operated by MNRS & Associates (hereinafter referred to as “MNRS”), and is meant for the information, awareness and education purposes only. MNRS does not warrant that any content or information contained on this Website is accurate, correct, complete or up-to-date, and hereby disclaims any and all liability to any person for any actual or imagined loss or damage caused by errors or omissions, whether such errors or omissions result from negligence, accident or otherwise. MNRS assumes no liability for the interpretation and/or use of the content and/or information contained therein, nor does it offer any warranty of any kind, either expressed or implied in relation to such content or information. Third-Party Links: MNRS does not intend that links / URLs contained or to be contained on this Website redirecting users to third party websites be considered as referrals to, endorsements of, or affiliations with any such third party. MNRS & Associates is not responsible for, and makes no representations or warranties, express or implied, about the content or information contained on such third party websites to which links may be provided on this knowledge-site.